Finchoice

FinChoice: Quick Loans To Smoothen Financial Bumps

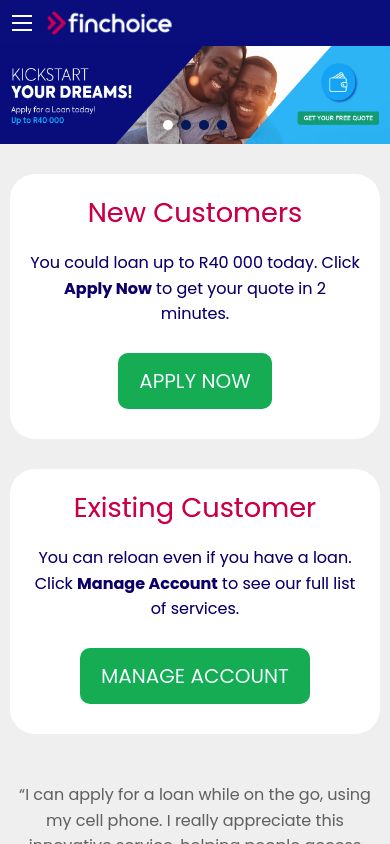

FinChoice offers fast, transparent, and convenient financial solutions for life’s unexpected challenges. With a customer-first approach, they provide tailored solutions for emergencies, regular expenses, or huge bills like funeral and accident cover. With flexible terms and fees, FinChoice accommodates a wide spectrum of borrowers. Their user-friendly platform enables anyone to quickly apply for a loan, get approved, and manage their loans with ease.

As an NCA accredited lender, FinChoice maintains baseline interest rates and industry best practices.

Why FinChoice Stands Out

- User-Friendly Platform: FinChoice’s mobile and online platforms are intuitive. Users can easily access funds, monitor their accounts, and apply for services without any hurdles.

- Reliable Customer Support: A dedicated team of call agents takes all your questions and even lets you negotiate loans directly.

- Regulated and Trustworthy: As a responsible lender, FinChoice operates under the strict guidelines of the NCA, prioritizing transparency and ethical practices.

FinChoice Loan Products

Get up to R100,000 with different terms and interest depending on your needs. FinChoice’s offers come in three main packages.

Personal Loans

FinChoice offers personal loans up to R40,000 with repayment terms up to 24 months.

Key benefits:

- Easy three-step application process.

- Transparent interest rates.

- No hidden fees.

MobiMoney™ Facility

MobiMoney™ is a digital credit card for covering expenses online. You can quickly access funds, airtime, data, and electricity fees all from your mobile phone.

Key benefits:

- Free setup

- Multiple withdrawals available

- Flexible repayment terms of up to three months.

- Instant access to funds anytime, anywhere.

KwikAdvance

Designed for emergencies, KwikAdvance provides quick access to cash when you need it the most, up to R10,000. Use this to fill short-term financial gaps and ensure you’re never caught off guard.

Funeral Cover

Give your deceased loved ones a proper farewell with FinChoice Funeral Cover. For R49 monthly, you can get up to R100,000 per individual and cover up to 19 individuals per plan.

Accident Cover

Accidents can be unpredictable and costly. FinChoice offers accident cover of up to R50,000 for only R39 per month. The plan covers both short- and long-distance trips, ensuring you’re protected wherever life takes you.

Application Process

Applying for FinChoice services is quick and straightforward:

- Visit the FinChoice website or login via their mobile app.

- Choose the service you need—whether it’s a loan, MobiMoney™, or insurance.

- Follow the easy on-screen prompts to complete your application.

Once submitted, you’ll receive a response within minutes. See for yourself why FinChoice is one of the fastest financial solutions in South Africa.

Eligibility Criteria and Required Documents

To qualify for FinChoice products, you need:

- A valid South African ID.

- Proof of income or payslips (depending on the loan type).

- A functional mobile device or computer for online applications.

The entire process is compliant with the National Credit Act (NCA), with accessibility checks and best practices for lending in South Africa.

Rates and Repayment Terms

FinChoice offers competitive interest rates with a moderate cost of borrowing. Repayment terms are flexible, with options ranging from a few months to two years for personal loans.

For MobiMoney™ and KwikAdvance, you get shorter repayment cycles for quicker financial resolution and to avoid long-term financial commitment. The regulated rates and transparent fee structures ensure you’re fully informed about your financial commitment.

Conclusion

FinChoice is a leader in the innovative lending space. Their wide range of flexible products, transparent terms, and a commitment to empowering customers makes financial wellness accessible to all.

So if you are looking for a personal loan, immediate cash access, or comprehensive insurance solutions, FinChoice is the right choice for you and ensures flexibility and transparency in every step of your loan journey.