Lime

Lime24 leads the way in the rising trend of fast loans that are obtainable online anytime, anywhere. Their popularity is mainly driven by their tailored financial products. From those seeking immediate cash solutions to people in need of a long-term safety net, Lime24 offers one of the most extensive lines of loans in South Africa.

With a straightforward user interface and seamless application process, Lime24 focuses on transparency, efficiency, and security. Lime24 also ensures a smooth borrowing experience with their flexible repayment terms, competitive interest rates, and fast approval rates.

All this makes Lime24 a reliable partner for managing short-term financial challenges.

Loan Products and Features

Lime24 loans are designed for financial emergencies and short-term cash flow needs. Here’s an overview of their loan offerings:

Payday Loans

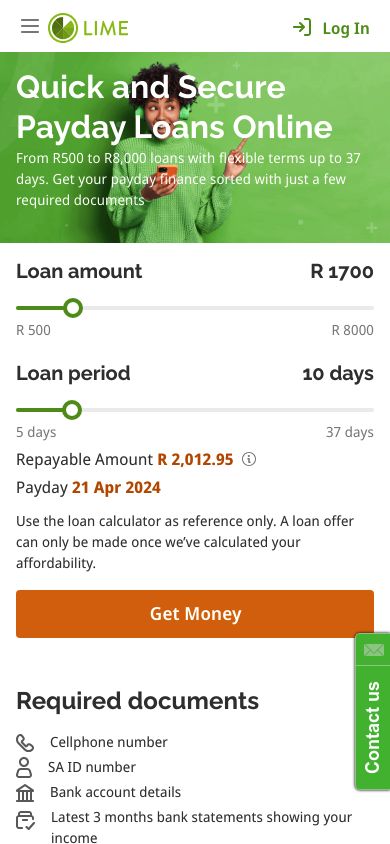

Borrow between R500 and R8,000. Use the loan for various financial needs, whether it's a minor expense or a larger, urgent obligation.

- Repayment Terms: Flexible terms ranging from 5 to 90 days.

- Interest: 10% - 30% depending on the loan amount, term, credit score, etc.

Personal loans

This option provides instant funding, often within hours of approval, with transparent fees with no hidden charges.

Application Process

Lime24 has simplified the borrowing process with a swift digital application system. All you need to do is:

Step 1: Start Your Application

Visit the Lime24 website and begin your loan application by providing basic personal details, including your phone number and email address.

Step 2: Submit Required Documents

Upload essential documents directly through the platform.

Step 3: Receive Loan Offer

After verifying your information, Lime24 conducts a credit and affordability check. You will then receive a personalized loan offer, detailing the loan amount, interest rate, fees, and repayment terms.

Step 4: Accept Offer and Receive Funds

Sign the loan agreement electronically. Once approved, the funds will be deposited directly into your bank account, usually on the same day.

Step 5: Repay Your Loan

Repayments can be scheduled via debit order or bank transfer, offering convenience and flexibility. Early repayment options are available to reduce interest costs.

Eligibility Criteria and Required Documents

Qualifying for a Lime24 loan is easy. But you need to meet a few basic requirements.

Eligibility Criteria:

- Residency: South African citizen or permanent resident with a valid ID.

- Income: Regular monthly income (minimum R3,000).

- Age: Applicants must be 18 years or older.

- Credit Check: Lime24 conducts a credit assessment to determine affordability.

Required Documents:

- South African ID: For identity verification.

- Bank Statements: The last 3 months showing consistent salary deposits.

- Proof of Income: Recent payslips or employment confirmation.

- Bank Details: A valid bank account for fund disbursement and repayments.

These requirements help Lime24 uphold responsible lending practices while providing borrowers with fair and manageable terms.

Rates and Repayment Terms

Lime24 offers clear and competitive rates. Their official website explicitly discloses all the applicable charges for their loans. Those include:

Interest Rates and Fees:

- Initiation Fees: A percentage-based initiation fee, compliant with South Africa’s National Credit Act.

- Monthly Service Fee: A fixed administration fee to cover ongoing account management.

- Interest Rates: Competitive rates that vary based on the loan amount, repayment term, and the borrower’s credit profile.

Flexible Repayment Options:

- Term Flexibility: Borrowers can select repayment periods between 5 and 90 days.

- Early Repayment: No penalties for repaying the loan early.

- Automated Repayments: Debit orders ensure timely payments to reduce the risk of default.

Your loan agreement will clearly outline all fees, interest rates, and repayment schedules.

Conclusion

Lime24 offers customer-centric financial solutions. Their payday and personal loans offer quick, secure, and flexible financing for short-term needs.

Whether you’re managing an unexpected expense or a temporary cash shortfall, Lime24 offers the tools and support you need to bridge the gap effectively.

Enjoy fast, straightforward, and responsible lending experience with Lime24 today.