Mpowa Finance

MPOWA Finance is a powerhouse of quick and convenient financial solutions. From short-term loans for unexpected expenses to fast cash advances, MPOWA promises a seamless application and high approval rates. Their flexible offering caters to diverse needs. With their user-friendly digital platform, you can apply for many different types of loans quickly and easily from the comfort of your home or on the go. Their quick loan offers often come through on the same day of application.

Plus, you can rest assured of transparent and competitive rates. As an NCR-accredited lender, MPOWA adheres strictly to regulatory limits, cultivating responsible lending practices.

Loan Products and Features

MPOWA’s loan varieties are designed for different financial needs. They mostly specialize in payday loans, with a wide range of loan amounts, repayment terms, and unique benefits. Here’s more on their offerings

Payday Loans

MPOWA’s primary offering is its payday loan product, which is designed to help individuals meet their immediate financial needs. Their payday loans provide instant access to funds, with a straightforward application process and secure transactions.

- Loan Amounts: R500 to R7,000

- Repayment Terms: 5 to 90 days

Personal Loans

Get personalized loan deals with terms and conditions tailored for easy repayment.

- Loan Amounts: R500 to R7,000

- Repayment Terms: 5 to 90 days

Repeat Borrowing

As a repeat borrower, you can enjoy reduced interest rates for all your subsequent loans. Plus, you can increase your loan limit after three successful repayments.

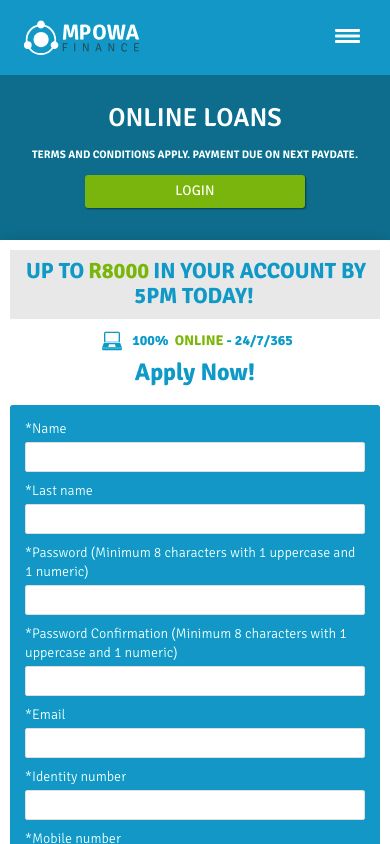

Application Process

No need to sweat it when applying for a loan on MPOWA. Just take a moment to:

- Complete the online application form.

- Provide required documents, including ID, bank statements, and proof of income.

- Receive approval and review the loan offer.

- Sign the loan agreement and receive funds directly in your bank account.

Eligibility Criteria and Required Documents

The fast approval process at MPOWA is thanks to their simple eligibility requirements. You’re still required to fulfill a few basic qualification criteria to ensure responsible borrowing. That includes a credit check, background check, and cash flow assessment.

To qualify, you need the following:

- South African Citizen or Permanent Resident: You must be a South African citizen or a permanent resident with a valid South African ID.

- Minimum Income: You must have a minimum monthly income of R4,000.

- Credit Check: While a poor credit score does not automatically disqualify you from receiving a loan, it may affect the loan amount or interest rate.

- Not Undergoing Debt Counseling: If you are currently undergoing debt counseling, you will not be eligible for a loan through MPOWA Finance.

Required Documents:

- South African ID: You will need to provide a valid South African ID for identity verification.

- Bank Account Details: To receive your MPOWA loan and set up repayment.

- Proof of Income: MPOWA requires proof of income to ensure that you have the ability to repay the loan. They can accept payslips, an employment contract, bank statements, or other documents showing your regular income.

If you meet these eligibility criteria and provide all necessary documents, MPOWA Finance can expedite the approval process and get you the funds you need as quickly as possible.

Rates and Repayment Terms

MPOWA Finance is transparent about its interest rates and fees. They clearly outline these charges in the loan agreement. Here’s an overview of the repayment terms:

Interest Rates:

- First Loan: For your first loan within a calendar year, you will be charged an interest rate of 4.5% per month. In terms of an annual percentage rate (APR), the interest stands at 54%. This is a relatively high interest rate, but it reflects the short-term nature of the loan.

- Subsequent Loans: If you take out additional loans within the same year, the interest rate drops to 3% per month (APR of 36%). This is done to reward customers for borrowing responsibly and repaying loans on time.

Fees:

- Initiation Fees: MPOWA Finance charges an initiation fee for each loan, which is calculated as a percentage of the loan amount. For loans under R1,000, the initiation fee is 16.5% of the loan amount, and for loans over R1,000, the initiation fee is 10%. These fees align with the National Credit Act cap.

- Service Fees: To cover the administrative costs associated with servicing your loan and repayment processing, MPOWA charges a service fee of R60 per month.

Repayment Terms:

- Flexible Repayment: You can choose a repayment period between 5 and 90 days.

- No Penalties for Early Repayment: If you can afford to pay off your loan earlier than the agreed-upon term, MPOWA Finance will not charge you any penalties.

MPOWA’s transparency ensures that you understand exactly what you will pay. No hidden fees or surprises.

Conclusion

MPOWA Finance offers a range of loan options for short-term and long-term financial needs. The application process is simple and approval is fast.

Use MPOWA to get the funds you need—quickly, securely, and affordably.