Wonga

Wonga South Africa is a trailblazing lender renowned for fast, transparent, and accessible short-term loan solutions. Their easy-to-use online platform empowers countless South Africans to manage their financial needs effectively.

They focus on responsible lending and customer education, with initiatives like The Money Academy and a loan calculator that helps users enjoy an easy and straightforward borrowing journey.

Their emphasis on transparency gives borrowers a clear understanding of repayment terms and helps them make informed decisions at all times.

Whether it’s an unexpected medical expense or a temporary cash-flow gap, Wonga is the place to go.

Loan Products and Features

Wonga specializes in short-term loans that provide immediate financial relief for various needs. Here’s an overview of their loan products:

Loan Amount Range

- Borrow amounts ranging from R500 to R8000 for first-time users.

- Returning customers may qualify for larger loan amounts based on their repayment history.

Flexible Repayment Periods

Choose a repayment term between 6 days and 6 months. Enjoy maximum flexibility to fit your financial situation.

Transparent Cost Structure

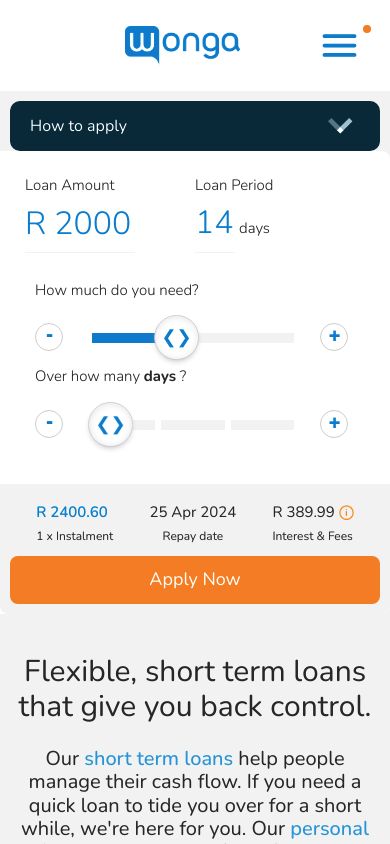

Wonga’s loan calculator displays the full cost of borrowing upfront, including interest rates and service fees. You can rest assured there are no risks of hidden charges.

Fast Payouts

Approved loans are disbursed quickly, often within hours of approval. Get the funds you need when you need them most.

User-Friendly Online Platform

Manage every step of the borrowing process—from application to repayment—entirely on one spot. Save your time and effort.

These features make Wonga an ideal choice if you’re seeking fast, reliable, and transparent financial solutions.

Application Process

Wonga’s application process is as simple as it gets. The entire process, from start to finish, only involves a few steps:

- Use the Loan Calculator: Input your desired loan amount and select your preferred repayment term to view the total cost, including interest and fees.

- Complete the Online Application Form: Provide personal details, such as your name, South African ID number, and contact information. Include proof of income and banking details to facilitate affordability checks.

- Submit Supporting Documents: Upload recent payslips, bank statements, and proof of address for verification.

- Approval Process: Wonga employs advanced algorithms and risk assessment tools to speed up the approval process. Most applicants receive an instant decision.

- Loan Disbursement: Once approved, funds are transferred directly to your bank account, typically within hours.

Eligibility Criteria and Required Documents

To ensure borrowers can manage their repayments responsibly, Wonga has clear eligibility requirements:

Basic Eligibility Criteria

- Applicants must be at least 18 years old.

- A valid South African ID is required.

- You need a South African bank account to receive funds.

Income Verification

- Provide proof of a stable income through recent payslips or bank statements.

Supporting Documents

- Bank statements showing income deposits and financial activity.

- Proof of address to confirm residency.

Affordability Assessment

- Wonga uses affordability checks to ensure applicants can repay their loans without financial strain.

These measures encourage responsible financial practices to protect both Wonga and borrowers from financial difficulties.

Rates and Repayment Terms

Wonga offers one of the most competitive interest rates that complies with regulations. Key aspects of their repayment terms include:

- Fixed Interest Rates: You’re charged a fixed rate, calculated based on the loan amount and repayment period. This ensures your monthly payments remain predictable.

- Zero Hidden Fees: Rest assured you won’t be charged any more than what you see on Wonga’s loan calculator. All costs are clearly outlined upfront, including initiation and monthly service fees.

- Flexible Repayment Options: Choose a repayment schedule that suits your budget, with terms ranging from a few days to six months.

- Early Settlement Benefits: You can repay your loans early without incurring penalties, potentially saving on interest costs.

Conclusion

Wonga South Africa stands out as a leader in the short-term lending space by combining cutting-edge technology with a customer-first approach. Whether you need quick access to funds or valuable financial education, Wonga provides the tools and resources to meet your needs. The transparent loan terms and seamless online application process prove their strong commitment to responsible lending. It’s no wonder Wonga is a trusted partner for thousands of South Africans.

Get a leg up in your financial journey and visit Wonga South Africa today.